Run On Less – Electric Report

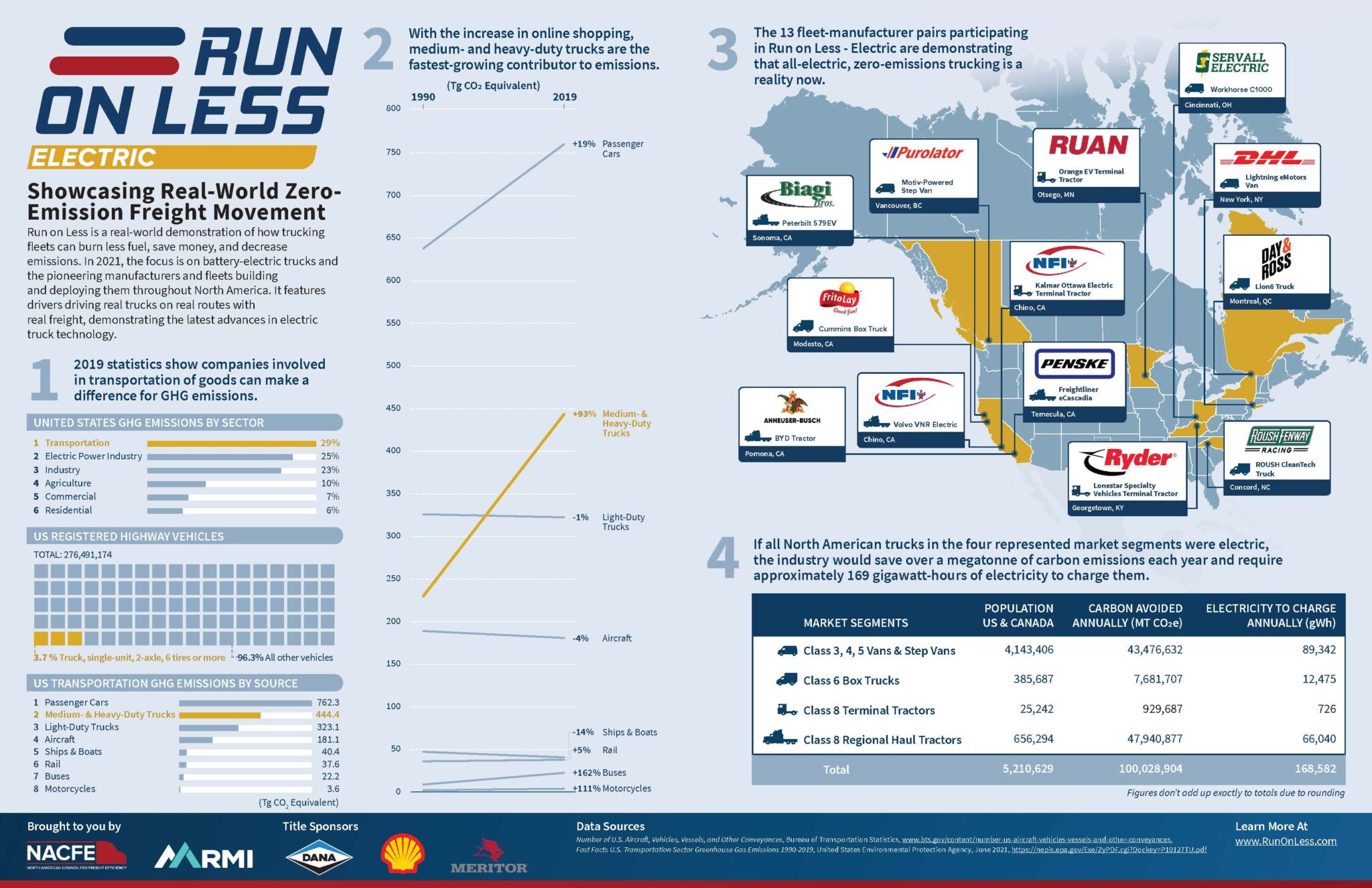

The Run on Less – Electric demonstration showed that for four market segments — vans and step vans, medium-duty box trucks, terminal tractors and heavy-duty regional haul tractors — commercial battery electric vehicles (CBEVs) are a viable option for fleets.

Thirteen fleet-OEM pairs participated in the Run:

- Anheuser-Busch with a BYD tractor

- Frito-Lay with a Cummins box truck

- Penske with a Freightliner eCascadia

- NFI with a Kalmar Ottawa terminal tractor

- DHL with a Lightning eMotors van

- Day & Ross with a Lion6 truck

- Ryder with a Lonestar Specialty Vehicles terminal tractor

- Purolator with a Motiv-Powered step van

- Ruan with an Orange EV terminal tractor

- Biagi Bros. with a Peterbilt 579EV

- Roush Fenway Racing with a ROUSH CleanTech truck

- NFI with a Volvo VNR

- Servall Electric with a Workhorse C1000

How It Worked

This report’s conclusions were generated through data collection and calculations from Run on Less – Electric. Twelve of the 13 vehicles were equipped with Geotab devices that tracked daily range, speed profiles, state of charge, charging events, amount of regenerative braking energy recovery, weather and number of deliveries. Data for one fleet was collected via the OEM’s own telematics device.

Results

RoL-E demonstrated that for four market segments — vans and step vans, medium-duty box trucks, terminal tractors, and heavy-duty regional haul tractors — the technology is mature enough for fleets to be making investments in production CBEVs. Continuous improvement is expected to be rapid as these technologies gain market share. The environmental benefit of reduced CO2 and particulate emissions is significant for replacing traditional diesel and gasoline-based vehicles.

Additional Findings Include:

- Early adopters of CBEVs are validating an acceptable total cost of ownership in urban medium-duty vans and trucks, terminal tractors and short heavy-duty regional haul applications.

- CBEV adoption is occurring throughout North America, but use of longer haul heavy-duty electric semi-trucks has been somewhat limited to California.

- There are benefits to CBEVs (quiet operation and reliability) as well as challenges (infrastructure and range).

- CBEV truck ecosystem inertia is in its early stages with many solutions emerging that will support adoption in the next several years.

- The industry needs to develop standards in the areas of charging, repair, maintenance and training.

- There is a huge demand for real-world information on electric vehicles in commercial applications and on charging infrastructure.

- The mix of startups, traditional truck OEMs, and component manufacturers is expediting the development of creative and practical solutions.

- More thought is needed on the best way to gather and manage the necessary data for fleets and manufacturers to measure and monitor their CBEVs.

- Early adopters of CBEVs are having an influence on improving trucks and infrastructure.

- CBEVs present operational challenges, for example longer charging times than fueling, which these fleets are working to mitigate.

Other Considerations

There is concern about the impact of both high and low temperatures on the performance of CBEVs, but because CBEVs are relatively new entrants into the trucking industry, many of the RoL-E fleets did not have firsthand experience in operating in a variety of weather conditions.

However, RoL-E fleets in Minnesota and New York City have operated their CBEVs through the winter with no performance issues. In addition, the Southern California and Modesto area sites saw extreme heat during the summer with drivers and fleet managers reporting no duty cycle limitations during site visits.

The three-week RoL-E demonstration was far too short to get any useful measured detail on maintenance. There is long-term reliability data on electric automobiles and buses showing that once vehicles are in production, their maintenance costs and failure rates trend downward versus internal combustion vehicles. This was the expectation of all the fleets in RoL-E.

Mountains and road grades also demand more energy from the batteries, just as diesels use more fuel climbing hills. What is advantageous, is that CBEVs can recover energy on the downhill segments.

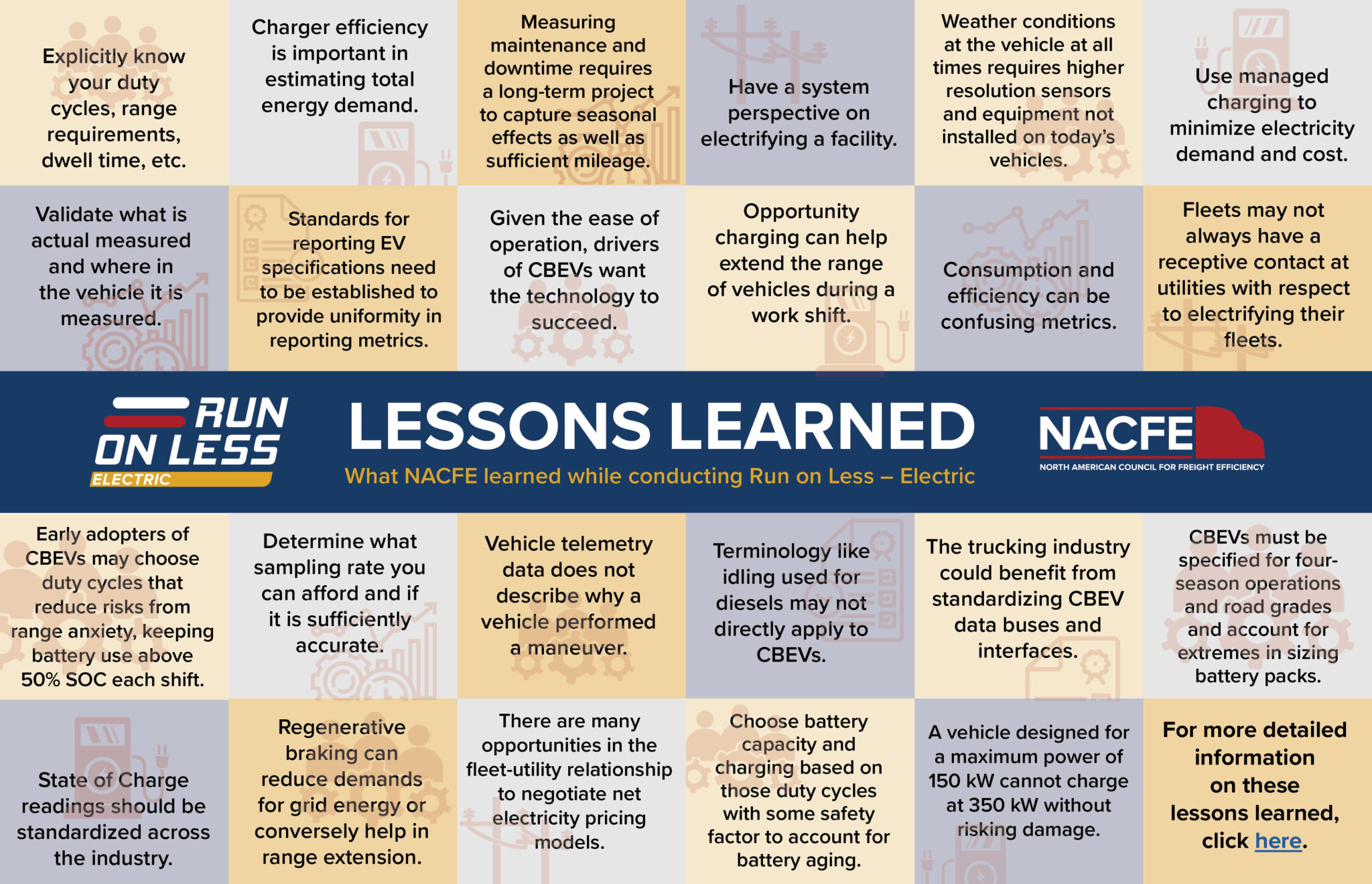

Lessons Learned

NACFE learned a number of lessons during the three weeks of the Run in the areas of charging, measuring performance, standardization, operations, and working with utilities.

Conclusions

RoL-E demonstrated that for four market segments — vans and step vans, medium-duty box trucks, terminal tractors and heavy-duty regional haul tractors — the technology is mature enough for fleets to be making investments in production CBEVs. NACFE encourages fleets to begin deploying CBEVs in these market segments as early adopters are validating an acceptable total cost of ownership in these four market segments.

View the original article.