What is Natural Gas?

Natural gas is a gaseous fuel that is composed of a mixture of hydrocarbons that consists mainly of Methane (CH4). Natural gas can be used for a large number of purposes including for electric power generation, industrial, and residential use for household heating and cooking purposes.

Natural gas powers more than 100,000 vehicles in the United States and roughly 11.2 million vehicles worldwide. Natural gas vehicles (NGVs) are a good choice for high-mileage fleets, such as buses and taxis, that are centrally fueled or operate within a limited area. The advantages of natural gas as an alternative fuel include its domestic availability, widespread distribution infrastructure, low cost compared with gasoline and diesel, and clean-burning qualities.

Natural Gas Vehicle Basics

Compressed Natural Gas (CNG) vs. Liquefied Natural Gas (LNG)

In order to fuel vehicles, natural gas has to be stored in a tank on board of the vehicle in either a compressed or liquefied state.

Compressed Natural Gas (CNG) is natural gas that has been compressed to less than 1% of its volume under standard atmospheric pressure. CNG is stored in tanks at a pressure of 3,600 PSIs (Pounds per Square Inch).

Liquefied Natural Gas (LNG) is stored in insulated tanks at -260 °F after being super-cooled, a process that liquifies natural gas.

Renewable Natural Gas

Renewable Natural Gas On-road Fuel Use Continues To Grow

Decarbonize Transportation with Renewable Natural Gas

How is it Produced?

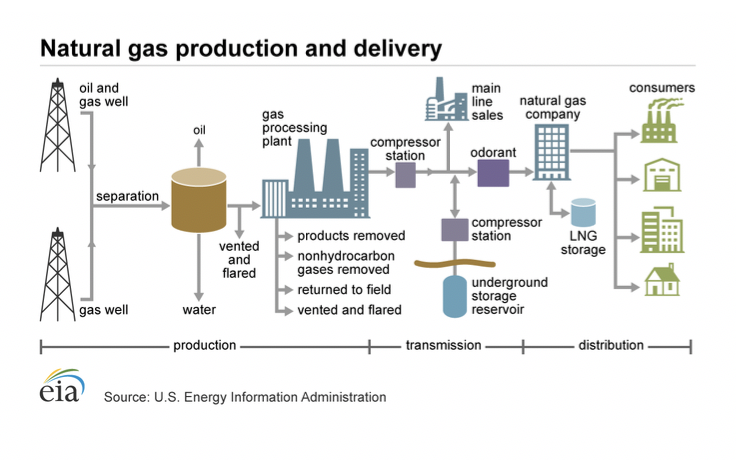

In the United States, most natural gas is extracted from gas and oil wells at the same time as crude oil production. Natural gas can also be extracted from shale rock formations with the help of horizontal drilling and hydraulic fracturing technology.

Renewable Natural Gas is extracted from waste management facilities including landfills, livestock operations, and wastewater treatment plants. RNG is treated to remove impurities and can be used directly to fuel vehicles or is delivered into the pipeline system.

Natural Gas Vehicles, Conversion and Distribution

Natural gas is transported via 305,000 miles of transmission pipelines and distributed via 2.2 million miles of distribution pipes into gas utility service areas.

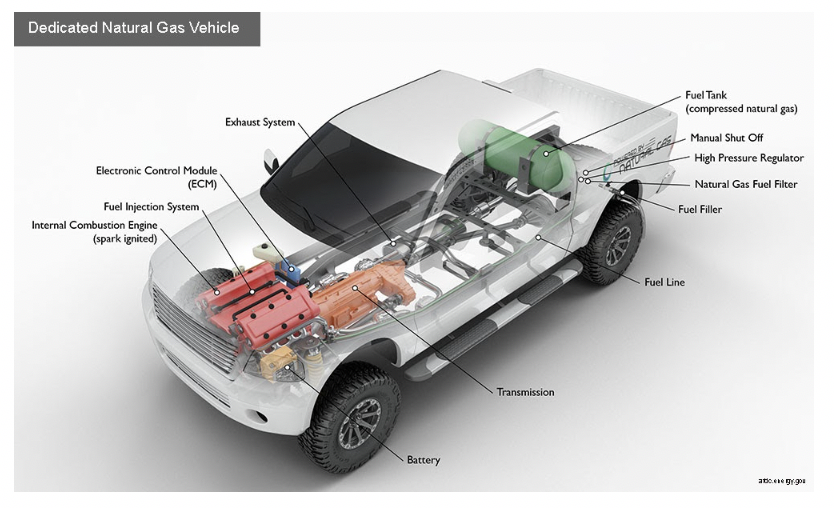

Like gasoline vehicles, Natural Gas vehicles utilize a spark-ignited internal combustion engine. Propane vehicles can have two configurations: dedicated (propane only) or bi-fuel (propane and gasoline)

Dedicated Vehicle: These vehicles are designed to run on only natural gas and are used in light-, medium-, and heavy-duty applications.

Bi-Fuel Vehicle: These vehicles are able to run on either natural gas or gasoline because they have two separate fueling systems. Bi-fuel vehicles include light-duty and medium-duty models.

Dual-Fuel Vehicle: These vehicles are primarily fueled by natural gas, but require diesel fuel of ignition. Dual-fuel vehicles are typically limited to heavy-duty vehicles.

To find CNG vehicles, LNG vehicles or other types of alternative fuel vehicles, visit: afdc.energy.gov/vehicles/search

CNG Conversion: All natural gas fueling systems and conversions have to comply with emissions standards set out by the Environmental Protection Agency or the California Air Resources Board. The EPA recommends that vehicle conversions be performed by Qualified System Retrofitters.

This video is provided by ECO Vehicle Systems.

Advantages

Performance: While CNG and conventional fuels have similar fuel economies, CNG has a lower energy density than conventional fuels, and can benefit from an additional storage tank to increase the range of a CNG vehicle.

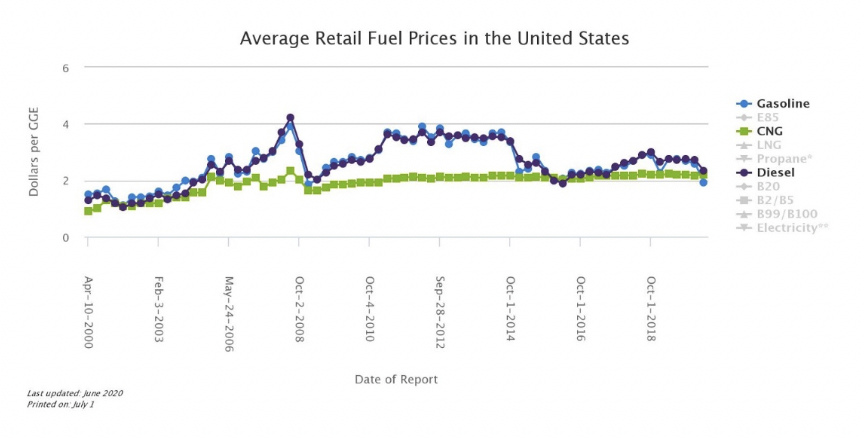

Fuel Costs: Over the past two decades, the price of CNG has been consistently lower than the price of diesel and gasoline. This will result in fuel savings for fleets that switch to CNG. The stability of CNG prices also insulates fleet owners from shocks caused by the price volatility of conventional fuels.

Greenhouse gases: On average, the use of natural gas as a transportation fuel in light-duty vehicles can reduce greenhouse gas emissions by 15% when compared to using gasoline. Greenhouse gas emissions reductions can reach 84% if RNG is used.

Considerations

Safety: CNG is a flammable gas that is stored at high pressures and requires different safety considerations from conventional fuels. Although CNG is naturally odorless, an odorant is added to CNG to alert drivers and fuel managers to potential leaks. If this occurs, the vehicle’s manual shut-off valve should be turned off and a qualified repair facility should be notified.

Safety: CNG is a flammable gas that is stored at high pressures and requires different safety considerations from conventional fuels. Although CNG is naturally odorless, an odorant is added to CNG to alert drivers and fuel managers to potential leaks. If this occurs, the vehicle’s manual shut-off valve should be turned off and a qualified repair facility should be notified.

Stored at – 260°F, LNG may cause cryogenic or freeze burns if it comes into contact with skin. Protective gear should be worn when handling LNG storage tanks and pipes.

LNG tanks may “vent” natural gases if it is stored unused over an extended period of time. This occurs when LNG warms up and vaporizes within the tank, causing relief valves to release LNG vapors in order to reduce the pressure of LNG storage tanks. Since LNG vapors are colder and denser than air, it may pool on the ground, causing a fire or asphyxiation hazard. For this reason, LNG storage or maintenance facilities should be well ventilated and LNG vehicles should be parked outdoors or in a well-ventilated garage.

Maintenance: CNG fuel systems require different maintenance compared to conventional fuel systems. CNG fuel filters should be inspected and replaced regularly by technicians and fuel tanks require regular safety inspections and must be replaced by the end of their useful life. Fuel Tank replacement should only be done by qualified service facilities.

Natural Gas Fueling Infrastructure

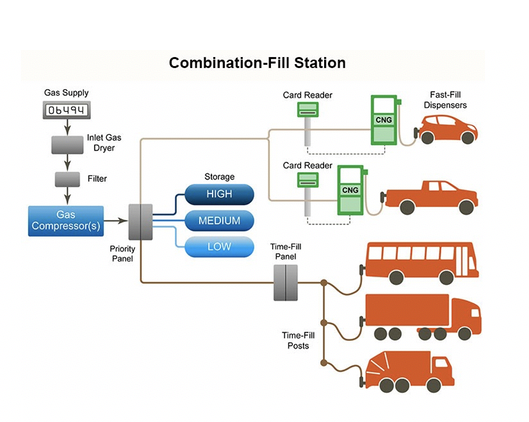

There are 3 types of CNG stations: Fast-fill, Time-fill, and Combination-Fill

Fast-fill: Retail CNG stations open to the public all offer fast-fill stations. This allows drivers to refuel and leave quickly. Fast-fill stations can refuel light-duty CNG vehicles with a 20-gallon tank in less than 5 minutes and heavy-duty vehicles at twice that rate. Fast-fill stations store CNG at pressures of 4,300 PSI in order to dispense CNG quickly. Low-pressure natural gas is delivered to fast-fill stations by a local utility and is compressed to a higher compressor on site, before it is stored in storage vessels.

Time-Fill: Time-fill stations are used primarily by fleets and heavy-duty vehicles that can refuel overnight. Similar to fast-fill stations, time-fill stations receive low pressure natural gas from the utility, but instead of using storage vessels, time-fill stations dispense fuel from the compressor directly into the vehicle. Refueling a vehicle using a time-fill station may take minutes or hours.

Combination-Fill: Combination-fill stations consist of time-fill and fast-fill fueling systems and can be beneficial for fleets that want to time-fill their own vehicles and make the fast-fill available to the public.

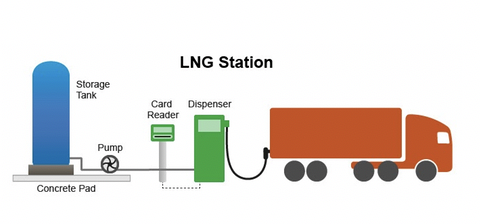

LNG stations are similar to gasoline and diesel fueling stations but may require protective gear and trained staff to operate since LNG is stored and dispensed as a super-cooled liquid that may pose a risk.

Cost of Infrastructure: A CNG Station can cost up to $1.8 million and the cost of installing a CNG or LNG station can depend on the scale, the type of the station, and other variables.

For more detailed information on Infrastructure costs, visit the following links:

AFDC Costs Associated with Compressed Natural Gas Vehicle Fueling Infrastructure

AFDC Vehicle and Infrastructure Cash-Flow Evaluation (VICE) Model

Fueling Stations and Corridors

As of 2020, there are 62 public LNG fuel stations and 876 public CNG fueling stations in the United States. In Indiana, there are 11 private LNG fuel stations and 25 public CNG stations.

There are currently 8 designated CNG corridors and 2 pending LNG corridors in Indiana.\

Use the Alternative Fuel Station Locator to find a station.

Indiana Incentives

Alternative Fuel Vehicle (AFV) Inspection and Maintenance Exemption

Alternative Fuel Vehicle (AFV) Inspection and Maintenance Exemption

Dedicated AFVs are exempt from inspection and maintenance requirements if they operate exclusively on natural gas, propane, ethanol, hydrogen, or methanol. (Reference 326 Indiana Administrative Code 13-1.1)

Compressed Natural Gas (CNG) Tax Credit

A carrier operating a commercial CNG vehicle on any Indiana highway may claim a credit equal to 12% of the road taxes imposed on its CNG consumption in the previous calendar quarter. The credit is refundable. (Reference Indiana Code 6-6-4.1-1 and 6-6-12)

Idle Reduction and Natural Gas Vehicle (NGV) Weight Exemption

Any motor vehicle equipped with an auxiliary power unit or other idle reduction technology may exceed the gross, single axle, tandem axle, or bridge formula weight limits by up to 400 pounds (lbs.) to compensate for the added weight of the idle reduction technology. Any NGV may exceed the limits by up to 2,000 lbs. (Reference Indiana Code 9-20-4-1)

Special Fuel Tax Exemption

The sale of biodiesel, blended biodiesel, and natural gas used to power an internal combustion engine or motor is exempt from state gross retail tax. (Reference Indiana Code 6-2.5-5-51 and 6-6-2.5-22)

Vehicle Research and Development Grants

The Indiana 21st Century Research and Technology Fund provides grants and loans to support economic development in high technology industry clusters. Incentives are available for qualified alternative fuel technologies and fuel-efficient vehicle development and production. For more information, see the Indiana Venture Development website. (Reference Indiana Code 5-28-16-2)

Indiana Laws

Alternative Fuel and Special Fuel Definitions

Alternative Fuel and Special Fuel Definitions

The definition of alternative fuel includes propane. Special fuel is defined as all combustible gases and liquids that are suitable for powering an internal combustion engine or motor or are used exclusively for heating, industrial, or farm purposes. Special fuels include biodiesel, blended biodiesel, and natural gas products, including liquefied and compressed natural gas. (Reference Indiana Code 6-6-2.5-1 and 6-6-2.5-22)

Alternative Fuel and Special Fuel Inventory Tax

Owners of fuel that have title to a fuel storage tank containing propane, biodiesel, blended biodiesel, or natural gas for sale to a motor carrier for highway use in Indiana are subject to an inventory tax. The tax rate is based on the number of gallons of fuel in storage at the close of business on the inventory date, minus the amount of fuel that is below the mouth of the draw pipe. To account for the fuel that will not be pumped, a fuel owner may deduct 200 gallons from the fuel inventory for a fuel storage tank with a capacity of less than 10,000 gallons, and 400 gallons for a fuel storage tank with a capacity of over 10,000 gallons. (Reference Indiana Code 6-6-4.1 and 6-6-2.5-29)

Certified Technology Park Designation

The Indiana Economic Development Corporation (IDEC) may designate an area as a certified technology park if certain criteria are met, including a commitment from at least one business engaged in a high technology activity that creates a significant number of jobs. The establishment of high technology activities and public facilities within a technology park serves a public purpose and benefits the public’s general welfare by encouraging investment, job creation and retention, and economic growth and diversity. High technology activities include advanced vehicles technology, which is any technology that involves electric vehicles, hybrid electric vehicles, or alternative fuel vehicles, or components used in the construction of these vehicles. For more information, see the IEDC Indiana Certified Technology Parks website. (Reference Indiana Code 36-7-32)

Clean Vehicle Acquisition Requirements

Each state entity must purchase or lease a clean energy vehicle, unless the Indiana Department of Administration (Department) determines that the purchase or lease of the vehicle is inappropriate for its intended use, or the purchase or lease would cost 20% more than a comparable non-clean energy vehicle. Additional exemptions apply. A clean energy vehicle is defined as a vehicle that operates on one or more alternative energy sources, including a rechargeable energy storage system, hydrogen, natural gas, and propane. Each state entity must annually submit to the Department information regarding its use of clean energy vehicles. (Reference Indiana Code 5-22-5-8.5)

Special Fuel License Tax

Certain special fuels sold or used to propel motor vehicles are subject to a license tax. Liquefied natural gas is subject to a tax per diesel gallon equivalent. Compressed natural gas, butane, and propane are subject to a tax per gasoline gallon equivalent. From July 1, 2018, through July 1, 2024, the tax rate will be determined each year based on the special fuel tax index factor. The tax does not apply to nominal biodiesel blends of at least 20% (B20); special fuel used only for a personal, noncommercial use and not for resale; and biodiesel used by a biodiesel producer holding an exemption certificate. Other exemptions apply. For the current tax rate and more information, see the Indiana Miscellaneous Tax Rates website. (Reference Indiana Code 6-6-2.5 and 6-6-1.6)

Special Fuel Motor Carrier Fuel Tax

A person who operates a commercial motor vehicle on any highway in Indiana is subject to a surcharge tax on the consumption of motor fuel. From July 1, 2018, through July 1, 2024, the tax rate will be determined each year based on the special fuel tax index factor. For the current tax rates and more information, see the Indiana Miscellaneous Tax Rates website. (Reference Indiana Code 6-6-4.1 and 6-6-1.6)

Fuel Taxes for Fleets and Consumer Forms

GA-110L Fillable Form

REF-1000 Extended Form

Resources

eia.gov/energyexplained/natural-gas/natural-gas-and-the-environment.php

afdc.energy.gov/fuels/natural_gas.html