What is an Electric Vehicle?

There are three types of vehicles powered by electricity:

Hybrid Electric Vehicles (HEVs): HEVs are powered by an Internal Combustion Engine along with an electric motor and a battery. HEVs do not rely on exterior power sources to charge their battery. Instead, they use a technology known as regenerative braking to capture energy loss from braking and stores the energy in the battery. In addition to driving, electricity can be used to power auxiliary cords and reduce engine idling in HEVs.

Plug-in Hybrid Electric Vehicles (PHEVs): Like HEVs, PHEVs are powered by an internal combustion engine as well as an electric motor and battery. PHEVs can draw electricity from the electric grid by using EV Charging Stations and generally have larger battery packs compared to HEVs. Much like HEVs, PHEVs can also generate electricity from regenerative braking. PHEVs run primarily on electricity and current models of PHEVs can travel up to 50 miles exclusively on electricity. After the battery has been depleted, PHEVs rely on conventional fuels to drive the vehicle.

All-electric Vehicles (EVs): EVs are powered solely by a battery pack which stores energy from the electric grid and powers an electric motor to drive the vehicle. EVs produce no tail-pipe emissions, unlike HEVs and PHEVs, but may contribute to upstream emissions due to fossil fuel power plants. Currently available models of EV’s have a range of up to 400 miles, with an average range of 230 miles per charge.

EV Conversions: Conventional vehicles can be converted to become HEVs, PHEVs, and EVs with help from certified installers. HEVs and PHEVs require certification from the Environmental Protection Agency and the California Air Resources Board. EVs do not require certification from the EPA or CARB unless it installs a device that produces emissions. There are over a dozen recognized EV conversion companies with a variety of services ranging from commercial fleet conversions to custom enthusiast builds.

Advantages

Driving Feel and Ease of Operation: Conventional vehicles use a complex drivetrain consisting of thousands of moving parts between the powerplant, transmission, and sensors that contribute to the driving experience. With electric vehicles, the simplicity of the integrated motor, single gearbox, and regenerative braking, results in fewer moving parts and contributes to a simple, straightforward operation and smoother driving feel.

Lower Maintenance Costs: HEVs and PHEVs require similar maintenance procedures as conventional vehicles, because they have an internal combustion engine. EVs require fewer maintenance procedures because there are fewer moving parts and fewer fluids to change. Batteries, motors, and other electronics used by EVs and PHEVs require little regular maintenance.

Regenerative braking on EVs, PHEVs, and HEVs leads to less wear-and-tear on the brake systems compared to conventional vehicles. Therefore, brake pads do not have to be replaced as frequently as conventional vehicles and also result in less particulate matter generated from brake dust.

Structural Advantages: With the absence of a typical front mounted internal combustion engine and transmission, electric vehicle manufacturers often utilize these spaces to further increase the vehicles internal occupancy, as well as allowing for more robust safety measures. Modern electric vehicles typically store their main battery packs low in the vehicle’s frame, leading to improved rigidity, lower rollover risk, and larger crumple zones. HEV and PHEV with internal combustion engines, regularly store these additional systems towards the rear of the vehicle, resulting in better weight distribution.

Updates and Support: Conventional vehicles rarely offer post-sale support from the manufacturer outside of hardware warranties, and typically appears in the form of limited GPS updates. Electric Vehicles, however, are uniquely positioned to receive over-the-air updates and support, that can directly improve and maintain the cars user features and physical driving experience through software improvements to the vehicles main computer or drivetrain.

Improved Air Quality: Conventional vehicles that have an internal combustion engine, produce tailpipe emissions which contain Criteria Air Pollutants such as Nitrogen Oxides (NOx), Sulfur Oxides (SOx), Carbon Monoxide, Ozone, Lead, and Particulate Matter. Criteria Air Pollutants contribute to air pollution and harm public health. EVs do not produce any tailpipe emissions while running. Similarly, PHEVs do not generate tailpipe emissions while running on electricity.

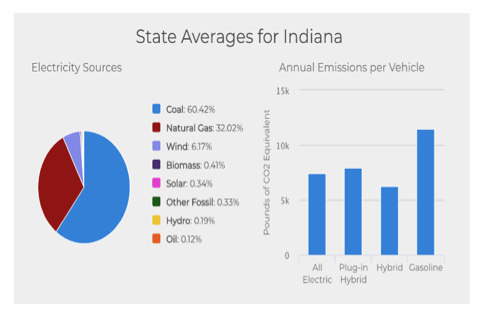

Reduced Greenhouse gas emissions: Although the total emissions of operating a PEV is lower compared to vehicles that use conventional fuels, the exact amount of emissions depends on the fuel mix of the source of electricity. Based on Indiana’s electricity generation mix, EVs, PHEVs, and HEVs are all estimated to emit less greenhouse gases than gasoline vehicles. Over time, the percentage of renewable sources of electricity is expected to increase along with grid efficiency, leading to even lower total lifecycle emissions.

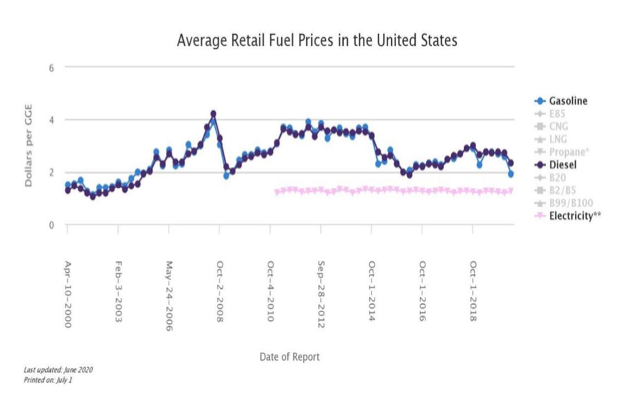

Fuel Savings: Over the past decades, electricity prices have held steady and remain consistently lower than the price of diesel and gasoline. EV owners and fleet managers will experience fuel savings from switching from conventional vehicles to EVs and PHEVs. The stability of electricity prices also insulates EV owners and fleet owners from shocks caused by the price volatility of conventional fuels.

Considerations

Costs: Although fuel costs for hybrid and plug-in electric vehicles are generally lower than for similar conventional vehicles, purchase prices can be significantly higher. However, prices are likely to decrease as production volumes increase and battery technologies continue to mature. Also, initial costs can be offset by fuel cost savings, a federal tax credit, and state incentives. The federal Qualified Plug-In Electric-Drive Motor Vehicle Tax Credit is available for PHEV and EV purchases until manufacturers meet certain thresholds of vehicle sales. It provides a tax credit of $2,500 to $7,500 for new purchases, with the amount determined by the size of the vehicle and capacity of its battery. Some states also offer incentives, which can be found in the Laws and Incentives database.

Use the Vehicle Cost Calculator to compare lifetime ownership costs of individual models of HEVs, PHEVs, EVs, and conventional vehicles.

Batteries: The advanced batteries in plug-in electric vehicles are designed for extended life but will degrade at a predictable rate. Several manufacturers of plug-in vehicles are offering 8-year/100,000-mile battery warranties. Predictive modeling by the National Renewable Energy Laboratory indicates that today’s batteries may last 12 to 15 years in moderate climates (8 to 12 years in extreme climates).

Check with your dealer for model-specific information about battery life and warranties. Although manufacturers have not published pricing for replacement batteries, some are offering extended warranty programs with monthly fees. If the batteries need to be replaced outside the warranty, it may be a significant expense. Battery prices are expected to decline as battery technologies improve and production volumes increase.

Charging

What is EVSE? EVSE stands for “Electric Vehicle Supply Equipment” and is the hardware used to plug-in an EV (electric vehicle) to recharge or refuel it.

EVs and PHEVs require Charging Stations or EVSE to recharge their batteries. Availability and accessibility of EVSE is a key determinant of EV adoption. Charging stations in the workplace and publicly available charging stations have been shown to encourage EV adoption.

At Home

Level 1 Chargers: Level 1 Chargers charge at a rate of 2-5 miles of range per 1 hour and can recharge an EV with up to 40 miles of range overnight (8 hours). Level 1 Chargers are the cord set that comes with the EV. It uses a 120 Volt, alternating current plug with a J1772 charge port. The Level 1 Charger can be plugged directly into a wall outlet.

Level 2 Chargers: Level 2 Chargers charge at a rate of 10-20 miles of range per 1 hour and can fully recharge an EV overnight (8 hours). Level 2 Chargers use a 240 or 208 Volt, alternating current plug with a J1772 charge port. The Level 2 Charger is a standalone charging station that requires installation and does not come with the EV.

On-the-Road

DC Fast Chargers: DC Fast Chargers charge at a rate of 60-80 miles of range per 20 minutes of charging and use a 480 Volt, direct current plug with three configurations of charge ports: CCS, Tesla, or CHAdeMO, which are only compatible with certain vehicles. The Level 2 Charger is a standalone charging station that requires installation and does not come with the EV.

Workplace charging: Greater Indiana Clean Cities partnered with Forth for our first-ever virtual EV Workplace Charging Workshop, presented by Knozone on September 30 and October 1, 2020. Event sponsors included Energy Systems Network, Ratio, Rolls Royce, and Springbuk. The two-day event provided an opportunity for corporate and municipality leaders in the state of Indiana and beyond to come together and learn from industry experts about the benefits and realities of electric vehicle charging in the workplace. The on-demand event sessions are listed below.

Day 1 – Wednesday, September 30

- Meet the Experts Panel: An Introduction to EVs and Charging Stations https://youtu.be/yaMye0hNrco

- Employer Experience Panel: Making the Case for Workplace Charging https://youtu.be/qrO1pP7Lkog

Day 2 – Thursday, October 1

- Removing the Red Tape: EV Charging Infrastructure Permitting and

- Codes https://youtu.be/2Id72ph-xag

- Interactive Session: Understanding EV Site Assessments and Creating a Plan https://youtu.be/TpCaMATMCpA

- Tools for Implementers: Data and Funding Resources https://youtu.be/i6rGAT4JG_c

Charging Stations and Corridors: As of 2020, there are 3,795 public DC fast charging stations (including Tesla) in the United States. In Indiana, there are 33 public DC fast charging stations (including Tesla). There are currently 5 designated EV corridors and 3 pending EV corridors in Indiana.

Use the Alternative Fuel Station Locator to find a station.

Indiana Incentives

Diesel Vehicle Retrofit and Improvement Grants: The Indiana Department of Environmental Management (IDEM) administers the DieselWise Indiana grant programs to support projects that reduce diesel emissions. The Clean Diesel Across Indiana program provides grants ranging from $10,000 to $75,000 for projects throughout the state. Eligible applicants include private and public entities that operate equipment serving the public, including private bus fleets and sanitation fleets. Eligible projects include replacing or converting a diesel vehicle or vehicle component with one that operates on alternative fuel, as well as installing exhaust retrofit technologies, idle reduction technologies, aerodynamic technologies, and low rolling resistance tires. For more information see the IDEM DieselWise website.

Medium and Heavy-Duty Grant Program: The Indiana Department of Environmental Management (IDEM) allocates a portion of its designated funds from the Volkswagen Environmental Mitigation Trust for the replacement or repower of eligible on-road and off-road vehicles and equipment. Eligible on-road vehicles and equipment include Class 4-8 trucks and Class 4-8 school, shuttle, and public transit buses. Eligible off-road vehicles and equipment include airport ground support equipment, forklifts, port cargo handling equipment, and freight-switcher locomotives. Applicants requesting funding must be registered with the Indiana Secretary of State. All vehicles and equipment must be certified or verified by the U.S. Environmental Protection Agency or the California Air Resources Board. Applicants proposing alternative fuel equipment or vehicle projects must identify the availability of fueling infrastructure. Additional terms and conditions apply. For more information, including current requests for proposals, see the IDEM Indiana VW Mitigation Trust Program website.

Vehicle Research and Development Grants: The Indiana 21st Century Research and Technology Fund provides grants and loans to support economic development in high technology industry clusters. Incentives are available for qualified alternative fuel technologies and fuel-efficient vehicle development and production. For more information, see the Indiana Venture Development website. (Reference Indiana Code 5-28-16-2)

EVs use a battery to store the electrical energy that powers the motor. EV batteries are charged by plugging the vehicle into an electric power source. Although electricity production may contribute to air pollution, the U.S. Environmental Protection Agency (EPA) considers EVs to be zero-emission vehicles because their motors produce no exhaust or emissions. Since EVs use no other fuel, they help reduce petroleum consumption.

Currently available EVs have a shorter range per charge than most conventional vehicles have per tank of gas. EV manufacturers typically target a minimum range of 100 miles. According to the U.S. Department of Transportation’s Federal Highway Administration, 100 miles is sufficient for more than 90% of all house- hold vehicle trips in the United States.

Light-duty HEV, PHEV, and EV models are currently available from a number of auto manufacturers, with additional models expected to be released in coming years. There are also a variety of medium and heavy-duty options available.

For up-to date information on available vehicle models, refer to the Alternative Fuels and Advanced Vehicles Data Center’s (AFDC) Electric Vehicle Availability page and FuelEconomy.gov.

Retro and reinstated tax credits for AF/Infrastructure SD: In 2013, President Obama signed Public Law 112-240, the American Taxpayer Relief Act of 2012. The resulting changes are available for review on the Alternative Fuels Data Center (AFDC) Federal Laws and Incentives page. Specifically, the Act: Expands the Qualified Plug-In Electric Drive Motor Vehicle Tax Credit to include a credit for eligible two- and three-wheeled plug-in electric drive vehicles, valid through December 31, 2013.

Qualified Plug-In Electric Drive Vehicle Tax Credit

Utility/Private Incentives

Plug-In Electric Vehicle (PEV) Charging Rate – Indiana Michigan Power

Indiana Michigan Power offers a lower electricity rate to residential customers when charging your electrified vehicle between 9pm and 7am during off peak hours. Known as Time-of-Use (ToU), Indiana Michigan Power may require customers to install a metering system that is capable of separately tracking PEV charging. For more information, see the Indiana Michigan Power Rates and Tariffs website.

Plug-In Electric Vehicle (PEV) Charging Rates – Indianapolis Power & Light

The Indianapolis Power & Light Co (IPL) offers special PEV charging rates, including year-round time-of-use based options, for residential and business customers who own a licensed PEV. Customers who are considering purchasing Level 2 electric vehicle supply equipment should contact IPL to discuss the benefits and requirements of participating in the program. Restrictions apply. For more information, see the IPL Electric Vehicle Charging website.

Point of Contact

Cole Willis

Electric Vehicle Program Manager

Indianapolis Power & Light Company

Phone: (317) 261-5178

[email protected]

Indiana Laws and Incentives

Certified Technology Park Designation: The Indiana Economic Development Corporation (IDEC) may designate an area as a certified technology park if certain criteria are met, including a commitment from at least one business engaged in a high technology activity that creates a significant number of jobs. The establishment of high technology activities and public facilities within a technology park serves a public purpose and benefits the public’s general welfare by encouraging investment, job creation and retention, and economic growth and diversity. High technology activities include advanced vehicles technology, which is any technology that involves electric vehicles, hybrid electric vehicles, or alternative fuel vehicles, or components used in the construction of these vehicles. For more information, see the IEDC Indiana Certified Technology Parks website. (Reference Indiana Code 36-7-32)

Clean Vehicle Acquisition Requirements: Each state entity must purchase or lease a clean energy vehicle, unless the Indiana Department of Administration (Department) determines that the purchase or lease of the vehicle is inappropriate for its intended use, or the purchase or lease would cost 20% more than a comparable non-clean energy vehicle. Additional exemptions apply. A clean energy vehicle is defined as a vehicle that operates on one or more alternative energy sources, including the following: a rechargeable energy storage system, hydrogen, natural gas, and propane. Each state entity must annually submit to the Department information regarding its use of clean energy vehicles. (Reference Indiana Code 5-22-5-8.5)

Electric Drive Vehicle Registration Fee: Battery electric vehicle owners are required to pay an additional registration fee of $150, and plug-in hybrid and hybrid electric vehicles are required to pay an additional registration fee of $50. The Indiana Bureau of Motor Vehicles will determine new fee amounts every five years. (Reference Indiana Code 9-18.1-5-12)

EV Resources

Preparing to Plug In Your Bus Fleet

https://afdc.energy.gov/fuels/electricity.html

Electric Vehicle Infrastructure Projection (EVI-Pro) Lite tool – The National Renewable Energy Laboratory has recently upgraded the tool to inform industry stakeholders about the electricity needed to charge plug-in vehicles. Within the tool, users can customize to their own specifications for location (city and state), number of plug-in vehicles, average daily miles per vehicle, average ambient temperature, all-electric vehicle share, vehicle type, share of workplace/home charging, charging levels, charging time of day.

https://afdc.energy.gov/vehicles/search/

https://www.shift2electric.com/evinfolist

https://afdc.energy.gov/case/3087 – Electric City, Utah

https://afdc.energy.gov/case/3090 – Electric Vehicles Charge up the Police Force

https://www.motorweek.org/features/auto_world/living-with-an-ev – Living with an EV

https://www.motorweek.org/features/goss_garage/autonomous-maintenance – Autonomous Maintenance

https://wisconsinenvironment.org/sites/environment/files/resources/WIE%20EV%20Toolkit%20Oct21-web_1.pdf – An Electric Vehicle Toolkit for Local Governments

EV Infrastructure Resources

https://afdc.energy.gov/fuels/electricity_infrastructure_development.html – Charging Infrastructure Procurement and Installation

https://afdc.energy.gov/fuels/electricity_infrastructure_maintenance_and_operation.html – Charging Infrastructure Operation and Maintenance

https://afdc.energy.gov/files/u/publication/evse_cost_report_2015.pdf – Costs Associated with Non-Residential EVSE

https://www.sccgov.org/sites/dnz/Pages/about-driving-to-net-zero.aspx – Example for municipalities seeking support in the deployment of PEVs and charging infrastructure.

https://www.sccgov.org/sites/dnz/Pages/siting-intalling-ev-charging-infrastructure.aspx – Siting and Installing EV Charging Infrastructure

https://www.sccgov.org/sites/dnz/Documents/Task4B-Deploying-EV-Charging-Infrastructure.pdf – Deploying PEV Charging Infrastructure: What Site Hosts Need to Know

https://www.evconnect.com/blog/maintenance-for-ev-charging-stations-what-to-know-about-ev-charger-repair/ – What to Know About EV Charger Repair

EV Pilot Program Examples

The City of Berkeley, California, Residential Curbside EV Charging Pilot – This is one of the first pilot programs in the United States allowing residents who currently lack off-street parking a means of charging their EVs at home. Find the Pilot Manual here.

The New York State Energy Research and Development Authority report, Curb Enthusiasm: Report for On-Street EV Charging – This report and its accompanying guidebook are resources for agencies as well as local governments looking to pilot curbside charging as the first step in a broader strategy to build an EV ecosystem. The guidebook provides helpful information on identifying and designing curbside stations.

The Seattle Department of Transportation, Electric Vehicle Charging in the Public Right-of-Way (EVCROW) Pilot Program – The EVCROW pilot allowed for electric vehicle supply equipment (EVSE) installation in the curbside locations throughout Seattle. Find the EVCROW Evaluation Report here.

The City of Sacramento, California, Curbside EV Charging Pilot – In 2017, the City of Sacramento partnered with EVgo for their first curbside EV charging pilot. Their Draft Policy Guidance report offers guidance and a procedure for public and private entities to install, operate, and maintain curbside EVSE.

The City of Takoma, Washington, EVSE Pilot Program – This program temporarily lifts the Right-of-Way Occupancy Permit requirement for property owners who wish to install EV charging equipment at the curbside next to their property. For more information, please see the Tip Sheet

Forth Mobility report, Right-Of-Way Charging: How Cities Can Lead the Way – This report includes a discussion of the benefits of curbside EVSE and includes best practices for implementation.