B20 Club of Indiana

B20 Club of Indiana

Fleets across Indiana rely on biodiesel, a high-performance and cleaner-burning fuel that’s made from soybeans and other renewable feedstocks produced in Indiana. Biodiesel is an easy-to-use and economical fuel option that improves air quality and lowers carbon footprints by reducing particulate matter and other harmful vehicle emissions. Greater Indiana is an Indiana Affiliated Partner of B20 Club of Indiana.

What is Biodiesel?

Biodiesel is defined as a renewable, biodegradable fuel derived from agricultural plant oils or animal fats that meet the ASTM D6751 specification. Learn the basics on biodiesel fuels.

What is Renewable Diesel?

Renewable diesel is a fuel with emission and carbon reduction qualities that are similar to biodiesel. Renewable diesel is sourced from renewable feedstocks, such as used cooking oil and distillers corn oil, but uses a different manufacturing process than biodiesel. Currently, most renewable diesel is used in California, but the fuel is expected to grow as production capacity expands throughout the country.

Biofuel Blends

Biodiesel can be blended with petroleum diesel fuel to create blends that have a range of concentrations and characteristics. The most common are biodiesel blends of B6 to B20 and B5. Low-level blends (B5 and below) are commonly identified as standard diesel as there is no separate labelling requirement at the pump. Biodiesel blends up to B5 meet the ASTM D975 specification for #2 diesel fuel (ULSD). Blends are defined by the volume percentage of biodiesel in the blend, such as B20(20% biodiesel/80% diesel) and B10 (10% biodiesel/90% diesel). (Reference Indiana Code 6-6-2.5-1.5)

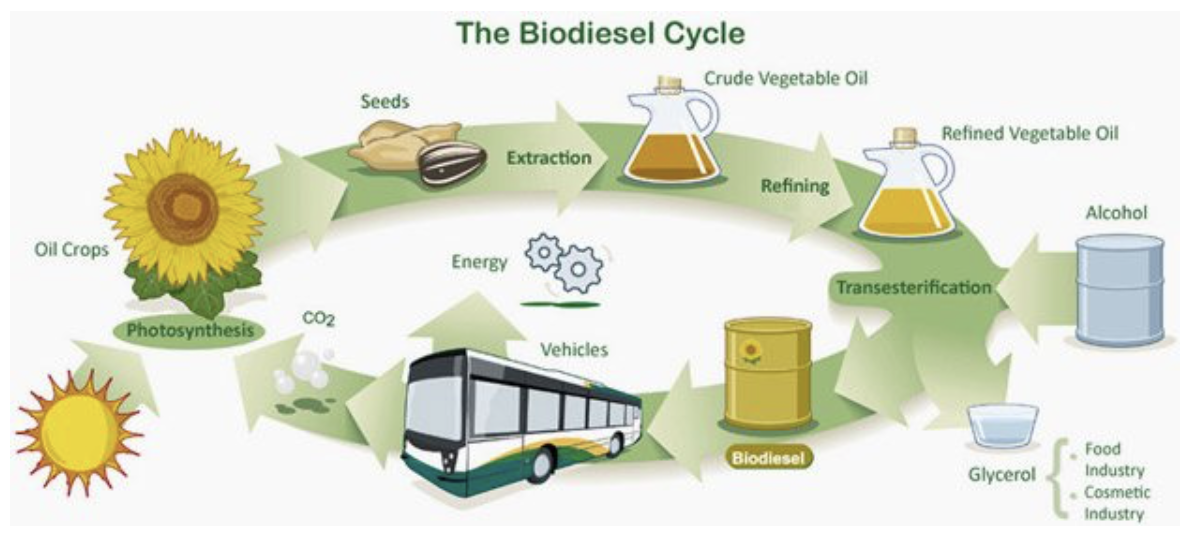

How is biodiesel produced?

Made from an increasingly diverse mix of resources such as recycled cooking oil, soybean oil and animal fats, biodiesel is a high-quality, cleaner-burning renewable biofuel. Biodiesel is available now for use in existing diesel engines without modification.

Can I use B20 in my vehicle’s diesel engine?

Biodiesel up to B20 blends can be used in diesel engines without modification. Unlike some alternative fuels, biodiesel can fuel existing diesel vehicles without investing in special equipment or fuel system infrastructure.Major diesel engine manufacturers and original equipment manufacturers (OEMs) approve blends up to B20. Some manufacturers approve B100 for use in certain types of equipment.

Check your OEM’s website or vehicle owner’s manual to determine which biodiesel blend is approved for your vehicle. You can also find general and manufacturer-specific information on the National Biodiesel Board website.

How can I find biodiesel?

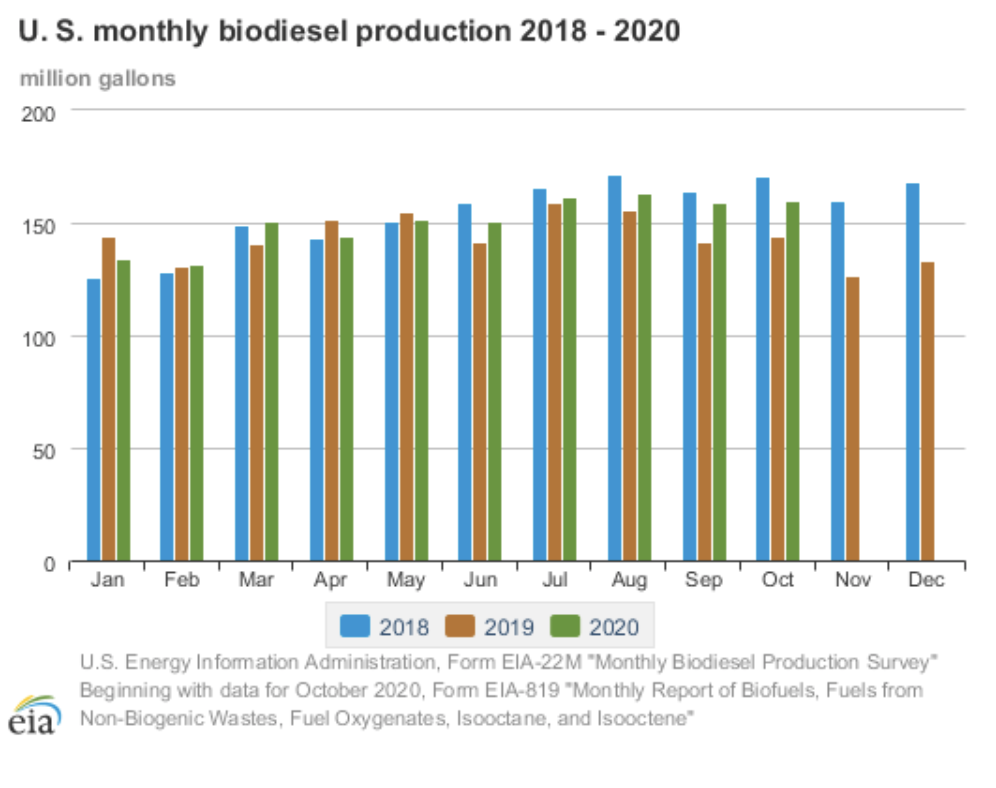

Biodiesel is available in all 50 states. According to the U.S. Energy Information Administration, U.S. biodiesel production capacity totals 2.5 billion gallons. When fueling, look for pump labels specifying biodiesel blends available at that location.

Advantages

Cleaner Burning: Vehicles fueled with biodiesel produce lower particulate matter and CO2 emissions for improved air quality. Biodiesel provides measurable health and environmental benefits for Indiana communities.

Performance: Biodiesel is a reliable and high-quality fuel that performs well in diesel vehicles. The energy density of biodiesel is measured by its calorific value which varies between blends. Typically these blends have a lower energy density than traditional petroleum diesel, but carry a higher Cetane rating and lubricity properties that result in a more complete combustion and partially compensate for the lower energy density.

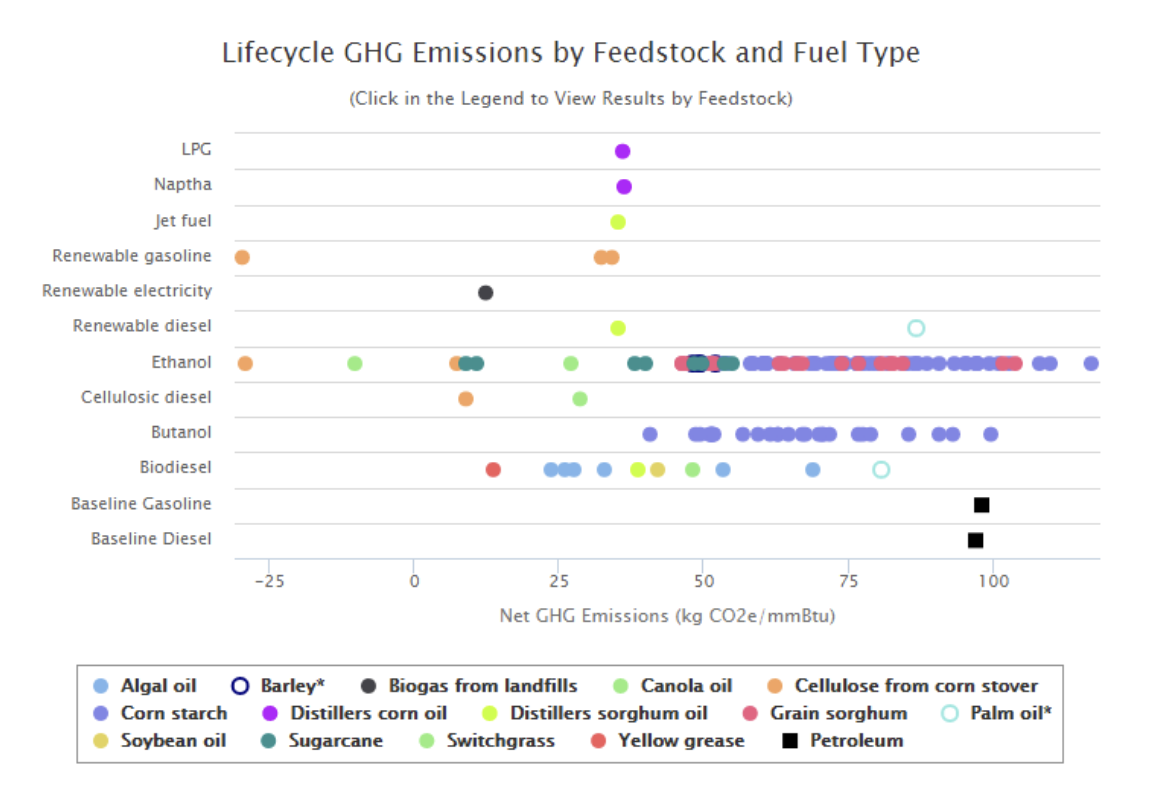

Reduced Greenhouse Gases: Biodiesel is a simple and economical way for fleets to meet carbon reduction goals. Emissions from biodiesel are a byproduct of a combustion process and are therefore regulated by the EPA to ensure compliance of fuel and emissions systems. When the lifecycle of biodiesel is analyzed Argonne National Laboratory found that tailpipe emissions for B100 are 74% lower relative to petroleum diesel. In a production analysis, ANL found that production of soy biodiesel showed a 75% reduction in GHG emissions compared to petroleum diesel, without considering Induced Land Use Change (ILUC). When ILUC is considered, overall emissions compared to petroleum was 66%-72%. Biodiesel systems also benefit from the same emissions reducing technology as their petroleum counterparts, such as exhaust gas recirculation systems and diesel particulate filters.

Criteria Air Pollutants: The EPA’s Renewable Fuel Standards Program Regulatory Impact Analysis shows that biodiesel from soy oil results in a 57% reduction in greenhouse gases compared to petroleum diesel. Further, biodiesel sourced from waste can result in an 86% reduction of total greenhouse gases. Learn more about the Renewable Fuel Standards program.

Lower Maintenance Costs: Biodiesel has a high lubricity and Cetane ratings compared to low sulfur petroleum diesel which leads to increased usable life of high pressure systems within the engine including fuel injectors and fuel pumps. The higher fuel pressure tolerances results in a higher compression ratio resulting in a cleaner and a more powerful combustion within the chamber.

Local Agricultural Support: Since biodiesel precursor feedstocks can be grown, procured, and refined domestically, the overall lifetime cost and carbon footprint of the fuel is substantially lower and directly stimulates local agricultural economies. Biodiesel reduces our dependence on imported oils.

Considerations

Cold Weather Performance:Biodiesel is an all-weather fuel. With proper cold weather additives, biodiesel performs as well as petroleum diesel in winter temperatures. Additives are designed to keep fuel temperatures above the the Cold Filter Plugging Point, the temperature that causes fuel filter clogging due to low temperature gelling and crystallization.

Fuel Efficiency: Power output of a biodiesel engine depends on the blend of the fuel and the conditions of the combustion. Typically, a higher thermal efficiency is attributed to higher compression ratios, resulting in a more powerful combustion. Typically biodiesels have a higher viscosity and flash point, making them safer to handle, but less thermally efficient.

Fuel Costs: Historically the average retail price of biodiesel, including federal and state taxes, of B2 to B5 were lower than petroleum diesel by .10c to .12c per gallon. Pure biodiesel typically sits at a higher range around $3.33 per gallon. https://afdc.energy.gov/fuels/prices.html

Biodiesel: Indiana Laws

Alternative Fuel and Special Fuel Definitions: The definition of alternative fuel includes propane. Special fuel is defined as all combustible gases and liquids that are suitable for powering an internal combustion engine or motor or are used exclusively for heating, industrial, or farm purposes. Special fuels include biodiesel, blended biodiesel, and natural gas products, including liquefied and compressed natural gas. (Reference Indiana Code 6-6-2.5-1 and 6-6-2.5-22)

Alternative Fuel and Special Fuel Inventory Tax: Owners of fuel that have title to a fuel storage tank containing propane, biodiesel, blended biodiesel, or natural gas for sale to a motor carrier for highway use in Indiana are subject to an inventory tax. The tax rate is based on the number of gallons of fuel in storage at the close of business on the inventory date, minus the amount of fuel that is below the mouth of the draw pipe. To account for the fuel that will not be pumped, a fuel owner may deduct 200 gallons from the fuel inventory for a fuel storage tank with a capacity of less than 10,000 gallons, and 400 gallons for a fuel storage tank with a capacity of over 10,000 gallons. (Reference Indiana Code 6-6-4.1 and 6-6-2.5-29)

Certified Technology Park Designation: The Indiana Economic Development Corporation (IDEC) may designate an area as a certified technology park if certain criteria are met, including a commitment from at least one business engaged in a high technology activity that creates a significant number of jobs. The establishment of high technology activities and public facilities within a technology park serves a public purpose and benefits the public’s general welfare by encouraging investment, job creation and retention, and economic growth and diversity. High technology activities include advanced vehicles technology, which is any technology that involves electric vehicles, hybrid electric vehicles, or alternative fuel vehicles, or components used in the construction of these vehicles. For more information, see the IEDC Indiana Certified Technology Parks website. (Reference Indiana Code 36-7-32)

Special Fuel License Tax: Certain special fuels sold or used to propel motor vehicles are subject to a license tax. Liquefied natural gas is subject to a tax per diesel gallon equivalent. Compressed natural gas, butane, and propane are subject to a tax per gasoline gallon equivalent. From July 1, 2018, through July 1, 2024, the tax rate will be determined each year based on the special fuel tax index factor. The tax does not apply to nominal biodiesel blends of at least 20% (B20); special fuel used only for a personal, noncommercial use and not for resale; and biodiesel used by a biodiesel producer holding an exemption certificate. Other exemptions apply. For the current tax rate and more information, see the Indiana Miscellaneous Tax Rates website. (Reference Indiana Code 6-6-2.5 and 6-6-1.6)

Special Fuel Motor Carrier Fuel Tax: A person who operates a commercial motor vehicle on any highway in Indiana is subject to a surcharge tax on the consumption of motor fuel. From July 1, 2018, through July 1, 2024, the tax rate will be determined each year based on the special fuel tax index factor. For the current tax rates and more information, see the Indiana Miscellaneous Tax Rates website. (Reference House Bill 1002, 2017, and Indiana Code 6-6-4.1 and 6-6-1.6)

Biodiesel: Indiana Incentives

Biodiesel Blend Tax Exemption: Biodiesel blends of at least 20% (B20) that are used for personal, noncommercial use by the individual that produced the biodiesel portion of the fuel are exempt from the special fuel license tax. The maximum number of gallons of fuel for which the exemption may be claimed is based on the percentage volume of biodiesel in each gallon used. For more information, see the Indiana Department of Revenue Fuel Tax Forms website. (Reference Indiana Code 6-6-2.5-1.5, 6-6-2.5-28, and 6-6-2.5-30.5)

Biodiesel Price Preference: A governmental body, state educational institution, or instrumentality of the state that performs essential governmental functions on a statewide or local basis is entitled to a 10% price preference for the purchase of fuels containing at least 20% biodiesel (B20) by volume or fuels that are primarily ester-derived (other than alcohol) made from biological materials, such as oilseeds and animal fats, for use in operating compression and ignition engines. (Reference Indiana Code 5-22-15-19)

Diesel Vehicle Retrofit and Improvement Grants: The Indiana Department of Environmental Management (IDEM) administers the DieselWise Indiana grant programs to support projects that reduce diesel emissions. The Clean Diesel Across Indiana program provides grants ranging from $10,000 to $75,000 for projects throughout the state. Eligible applicants include private and public entities that operate equipment serving the public, including private bus fleets and sanitation fleets. Eligible projects include replacing or converting a diesel vehicle or vehicle component with one that operates on alternative fuel, as well as installing exhaust retrofit technologies, idle reduction technologies, aerodynamic technologies, and low rolling resistance tires. For more information see the IDEM DieselWise website.

Vehicle Research and Development Grants: The Indiana 21st Century Research and Technology Fund provides grants and loans to support economic development in high technology industry clusters. Incentives are available for qualified alternative fuel technologies and fuel-efficient vehicle development and production. For more information, see the Indiana Venture Development website. (Reference Indiana Code 5-28-16-2)

Biodiesel is a domestically produced, renewable fuel that can be manufactured from new and used vegetable oils, animal fats, and recycled restaurant grease. Biodiesel’s physical properties are similar to those of petroleum diesel, but it is a cleaner-burning alternative. Using biodiesel in place of petroleum diesel significantly reduces emissions of toxic air pollutants.

Special Fuel Tax Exemption: The sale of biodiesel, blended biodiesel, and natural gas used to power an internal combustion engine or motor is exempt from state gross retail tax. (Reference Indiana Code 6-2.5-5-51 and 6-6-2.5-22)

Special Fuel License Tax: The tax does not apply to nominal biodiesel blends of at least 20% (B20); special fuel used only for a personal, noncommercial use and not for resale; and biodiesel used by a biodiesel producer holding an exemption certificate. Other exemptions apply. For the current tax rate and more information, see the Indiana Miscellaneous Tax Rates website. (Reference Indiana Code 6-6-2.5 and 6-6-1.6)

Retro and reinstated tax credits for AF/Infrastructure SD: January 2, 2013, President Obama signed Public Law 112-240, the American Taxpayer Relief Act of 2012. The resulting changes are available for review on the Alternative Fuels Data Center (AFDC) Federal Laws and Incentives page afdc.energy.gov/laws/fed_summary. Specifically, the Act: Retroactively extends several tax credits that had expired on December 31, 2011.

Alternative Fuel Excise Tax Credit:

afdc.energy.gov/laws/law/US/319

Public Law 112-240, Section 412

Alternative Fuel Infrastructure Tax Credit:

afdc.energy.gov/laws/law/US/10513

Public Law 112-240, Section 402

Alternative Fuel Mixture Excise Tax Credit:

afdc.energy.gov/laws/law/US/417

Public Law 112-240, Section 405

Expands the definition of second generation biofuel (previously referred to as cellulosic biofuel) to include biofuel from cultivated algae, cyanobacteria, or lemna, and extends two incentives related to these fuels through December 31, 2013:

Second Generation Biofuel Plant Depreciation Deduction Allowance:

afdc.energy.gov/laws/law/US/413

Public Law 112-240, Section 410

Second Generation Biofuel Producer Tax Credit:

afdc.energy.gov/laws/law/US/10515

Public Law 112-240, Section 404

Extends discretionary funding for the following U.S. Department of Agriculture programs through September 2013:

Advanced Biofuel Production Grants and Loan Guarantees:

afdc.energy.gov/laws/law/US/9172

Advanced Biofuel Production Payments:

afdc.energy.gov/laws/law/US/8503

Ethanol Infrastructure Grants and Loan Guarantees:

afdc.energy.gov/laws/law/US/9172

Fuel Taxes for Fleets and Consumers Forms:

GA-110L Fillable (05-17)

REF-1000 Extended (05-17)

Resources

Biodiesel Fuel Basics (EERE)

Alternative Fuels Data Center (AFDC) Biodiesel page

FuelEconomy.gov Biodiesel Page

Indiana Soybean Alliance

National Biodiesel Board

Join the National Biodiesel Board

American Lung Association

Renewable Energy Group

Biodiesel 101

B100: A Simple Sustainable Solution

Ultra Clean – The Latest Innovation In Renewable Fuel

Renewable Energy Group: Fuel Forward

Renewable Energy Group: Biodiesel Plant Tour

Biodiesel Performance: Inside a Biodiesel Engine

What to Expect for Clean Fuels in 2021

Fuel Transitions and Fleet Decision Making Webinar

Fuel Transitions and Fleet Decision Making PDF

This PDF and video is made possible by the National Biodiesel Board.