What is Propane?

Propane is a versatile alternative fuel that can be used in a variety of settings. Also known as liquefied petroleum gas (LPG), Propane has been used to power vehicles in many industries within the transportation sector, such as school buses, public transit buses, forklifts, lawnmowers and other agricultural equipment, and law enforcement vehicles. In addition to the transportation sector, propane has been used in residential settings for household heating and cooking purposes.

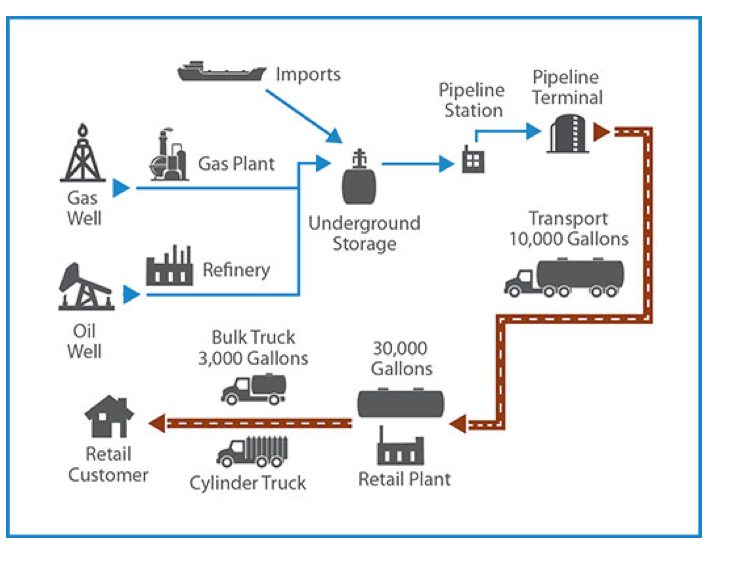

How is it Produced?

Propane is a versatile alternative fuel that can be used in a variety of settings. Also known as liquefied petroleum gas (LPG), Propane has been used to power vehicles in many industries within the transportation sector, such as school buses, public transit buses, forklifts, lawnmowers and other agricultural equipment, and law enforcement vehicles. In addition to the transportation sector, propane has been used in residential settings for household heating and cooking purposes. In 2014, 99% of the U.S. propane supply was produced in the U.S. or Canada.

Propane Vehicles and Distribution

Like gasoline vehicles, propane vehicles utilize a spark-ignited internal combustion engine. Propane vehicles use either vapor or liquid-injection systems.

Vapor-Injected Systems: Liquid propane travels along a fuel line into the engine compartment. The supply of propane to the engine is controlled by a regulator or vaporizer, which converts the liquid propane to a vapor. The vapor is then fed to a mixer located near the intake manifold where it is metered and mixed with filtered air before being drawn into the combustion chamber and burned to produce power, similar to gasoline. An example is the Alliance AutoGas Prins bi-fuel system.

Liquid Propane Injection Systems: Propane is not vaporized. Instead, it is injected into the combustion chamber in liquid form. Examples are the CleanFUEL USA and Roush CleanTech technologies.

Propane vehicles can have two configurations: dedicated (propane only) or bi-fuel (propane and gasoline)

Dedicated Vehicle: These vehicles are designed to run on only propane and are used in light-, medium-, and heavy-duty applications.

Bi-Fuel Vehicle: These vehicles are able to run on either propane or gasoline because they have two separate fueling systems. Bi-fuel vehicles include light-duty models and, more recently, medium- and heavy-duty vehicles.

All propane fueling systems and conversions have to comply with emissions standards set out by the Environmental Protection Agency or the California Air Resources Board. The EPA recommends that vehicle conversions be performed by Qualified System Retrofitters

To find propane vehicles or other types of alternative fuel vehicles, visit the following link: https://afdc.energy.gov/vehicles/search

Advantages

Performance: Propane has a higher octane number than gasoline, resulting in a higher fuel economy for propane vehicles compared to gasoline vehicles.

Greenhouse gases: On average, the use of propane as a transportation fuel can reduce greenhouse gas emissions by 13% when compared to using gasoline.

Compared to Gasoline, Propane reduces GHGs by 12% for Light Duty Vehicles and GHGs by at least 12% for School buses. Compared to Diesel, Propane reduces GHGs by 12% for Medium Duty Vehicles

Criteria Air Pollutants: Propane combustion produces less air pollutants than gasoline and diesel combustion, improving air quality. Compared to Gasoline, Propane reduces NOx by 5% and SOx by 37% for Light Duty Vehicles and NOx by at least 15% and SOx by at least 38% for School Buses. Compared to Diesel, Propane reduces NOx by 4% for Medium Duty Vehicles.

Lower maintenance costs: Studies show that Propane Is low-carbon and low oil-contamination characteristics may increase the engine life of propane vehicles and results in maintenance costs over the lifetime of the vehicle.

Considerations

Energy Density: Propane has a lower energy density (27%) than gasoline. Therefore, propane vehicles require a larger fuel storage system than gasoline vehicles.

Fuel Costs: Although the price of propane has been higher than conventional fuels in recent years, it is less vulnerable to price volatility.

Propane Fueling Infrastructure

The cost of propane fueling infrastructure varies by scale and specifications. Propane fueling infrastructure is very similar to gasoline equipment, including:.

Storage Tanks: Propane is delivered by trucks and stored in storage tanks that can cost between $5000 and $100,000

Propane Dispenser: A propane dispenser delivers propane from the storage tank to the vehicle and can cost between $5,000 and $35,000. Dispensers can vary by fueling flow rate, fuel management system, number of dispenser hoses and other factors.

Pump and Motor: Propane is delivered from the storage tank to the dispenser with the help of a pump, which is powered by a motor. A pump and motor system can cost between $4,000 and $15,000.

Fuel Management System: Fuel management systems monitor the amount of propane that is delivered to a vehicle and can vary in sophistication and collect different types of vehicle and fuel usage data. Fuel management systems can cost between $5,000 to $35,000.

Public propane stations require a credit card reader in order to accept payment.

Federal regulations also require a “competent attendant” to fuel propane vehicles, so drivers may need to be trained before they can use an unmanned pump. (Title 29 of the Code of Federal Regulations, section 1910.110; National Fire Protection Association (NFPA) 58 and 54).

Fueling stations may fall into one of the following categories:

Skid-Mounted: The storage tank, dispenser, pump, and any additional piping or controls are mounted to a portable concrete or steel frame that can be installed easily, removed, or relocated. Skid-mounted systems tend to be more affordable than stationary equipment.

Stationary: In a stationary system, the storage tank may be underground, and the station may include additional features not available on a skid-mounted system, including spill-proof pumps and additional metering capabilities.

Fueling Stations and Corridors

As of 2020, there are 914 public LPG stations in the United States. In Indiana, there are 61 public and 6 private LPG stations (shown in the map with dotted lines.)

There are currently 4 designated propane corridors and 3 pending propane corridors in Indiana.

Use the Alternative Fuel Station Locator to find a station.

Indiana Incentives

Alternative Fuel Vehicle (AFV) Inspection and Maintenance Exemption

Dedicated AFVs are exempt from inspection and maintenance requirements if they operate exclusively on natural gas, propane, ethanol, hydrogen, or methanol. (Reference 326 Indiana Administrative Code 13-1.1)

Diesel Vehicle Retrofit and Improvement Grants

The Indiana Department of Environmental Management (IDEM) administers the DieselWise Indiana grant programs to support projects that reduce diesel emissions. The Clean Diesel Across Indiana program provides grants ranging from $10,000 to $75,000 for projects throughout the state. Eligible applicants include private and public entities that operate equipment serving the public, including private bus fleets and sanitation fleets. Eligible projects include replacing or converting a diesel vehicle or vehicle component with one that operates on alternative fuel, as well as installing exhaust retrofit technologies, idle reduction technologies, aerodynamic technologies, and low rolling resistance tires. For more information see the IDEM DieselWise website.

Propane Equipment and Infrastructure Liability Exemption

Propane equipment, infrastructure, and fuel providers are exempt from civil liability for personal injury or property damage resulting from an individual who modifies, repairs, materially alters, or uses propane equipment or fuel for purposes not intended by the manufacturer or fuel producer. (Reference Indiana Code 34-31-11.2-2)

Vehicle Research and Development Grants

The Indiana 21st Century Research and Technology Fund provides grants and loans to support economic development in high technology industry clusters. Incentives are available for qualified alternative fuel technologies and fuel-efficient vehicle development and production. For more information, see the Indiana Venture Development website. (Reference Indiana Code 5-28-16-2)

Indiana Laws

Alternative Fuel and Special Fuel Definitions

The definition of alternative fuel includes propane. Special fuel is defined as all combustible gases and liquids that are suitable for powering an internal combustion engine or motor or are used exclusively for heating, industrial, or farm purposes. Special fuels include biodiesel, blended biodiesel, and natural gas products, including liquefied and compressed natural gas. (Reference Indiana Code 6-6-2.5-1 and 6-6-2.5-22)

Alternative Fuel and Special Fuel Inventory Tax

Owners of fuel that have title to a fuel storage tank containing propane, biodiesel, blended biodiesel, or natural gas for sale to a motor carrier for highway use in Indiana are subject to an inventory tax. The tax rate is based on the number of gallons of fuel in storage at the close of business on the inventory date, minus the amount of fuel that is below the mouth of the draw pipe. To account for the fuel that will not be pumped, a fuel owner may deduct 200 gallons from the fuel inventory for a fuel storage tank with a capacity of less than 10,000 gallons, and 400 gallons for a fuel storage tank with a capacity of over 10,000 gallons. (Reference Indiana Code 6-6-4.1 and 6-6-2.5-29)

Certified Technology Park Designation

The Indiana Economic Development Corporation (IDEC) may designate an area as a certified technology park if certain criteria are met, including a commitment from at least one business engaged in a high technology activity that creates a significant number of jobs. The establishment of high technology activities and public facilities within a technology park serves a public purpose and benefits the public’s general welfare by encouraging investment, job creation and retention, and economic growth and diversity. High technology activities include advanced vehicles technology, which is any technology that involves electric vehicles, hybrid electric vehicles, or alternative fuel vehicles, or components used in the construction of these vehicles. For more information, see the IEDC Indiana Certified Technology Parks website. (Reference Indiana Code 36-7-32)

Propane Vehicle Decals

An individual may place propane into the fuel tank of a motor vehicle only if the vehicle has a valid alternative fuel decal affixed to the front windshield or the individual has submitted an application for a decal within the last 30 days. The cost of the decal varies according to vehicle type and the gross vehicle weight rating. The annual fee may be prorated if the vehicle is newly purchased, registered in Indiana, or converted to operate using an alternative fuel. For propane vehicles registered outside of Indiana, owners must purchase a temporary trip permit from a licensed propane dealer. For more information, see the Indiana Department of Revenue Fuel Tax Forms website. (Reference Indiana Code 6-6-14 and 6-6-2.5-67)

Special Fuel License Tax

Certain special fuels sold or used to propel motor vehicles are subject to a license tax. Liquefied natural gas is subject to a tax per diesel gallon equivalent. Compressed natural gas, butane, and propane are subject to a tax per gasoline gallon equivalent. From July 1, 2018, through July 1, 2024, the tax rate will be determined each year based on the special fuel tax index factor. The tax does not apply to nominal biodiesel blends of at least 20% (B20); special fuel used only for a personal, noncommercial use and not for resale; and biodiesel used by a biodiesel producer holding an exemption certificate. Other exemptions apply. For the current tax rate and more information, see the Indiana Miscellaneous Tax Rates website. (Reference Indiana Code 6-6-2.5 and 6-6-1.6)

Additional Resources

Propane Education Resource Council (PERC)

Alternative Fuels Data Center (AFDC) Propane page

National Propane Gas Association